What Must Change if Future Evidence Pricing and Access Challenges to Healthcare Technologies Are to Be Overcome Successfully?

Christopher Teale, BSc, TealeHealth, Chesterfield, UK; Richard Tolley, BSc, FIECON, London, UK; Samantha Morrison, BSc, Partners for Access, London, UK; Andrew Ballantyne, MBA, Ipsos, London UK

Healthcare technologies are evolving rapidly but the systems used to support the assessment, appraisal, access, and funding of these technologies are evolving more slowly. This disparity in speed of evolution will create future evidence pricing and access challenges.

Using the ISPOR top 10 HEOR trends1 as a catalyst, a 2-cycle delphi approach based on broad expert opinion (n=41) that included payer experts in immunology and oncology based in the European Union, the United States, and Asia Pacific and representatives from Ipsos’ autoimmune and oncology centers of expertise was used to determine the likely key evidence pricing and access challenges over the period 2023-2030 and requirements for their solution.

Scope covered the complete lifecycle pathway from drug discovery to loss of exclusivity (LoE); evolution of digital health technologies including predictive analytics and artificial intelligence (AI); patient selection informed by genomics; and value attribution in situations where value is delivered by multi-component disease management rather than by drugs or interventions in isolation.

Challenges

Cluster analysis was used to reduce the many challenges into 10 distinct “challenge clusters”: affordability, evidence, assessment, pricing, differentiation, sequencing, personalization, value attribution, portfolio optimization, and pace of change.5

The challenges, which were applicable to most therapy areas, involved multiple stakeholders (physicians, payers, patients, pathologists, politicians, and pharmaceutical manufacturers). Capability requirements were identified that centerd around “willingness” (to pay, to change behaviors, to invest, to collaborate) and “ability” (to pay, to access, integrate, and accept data from multiple sources).

The research indicated that the challenges could rarely be overcome by companies working in isolation, or by limiting solutions to single data types or sources.

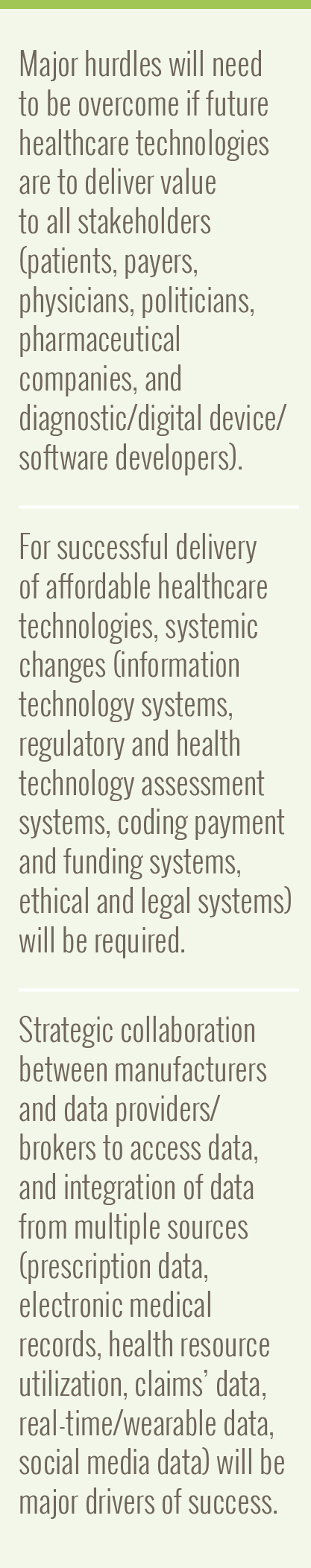

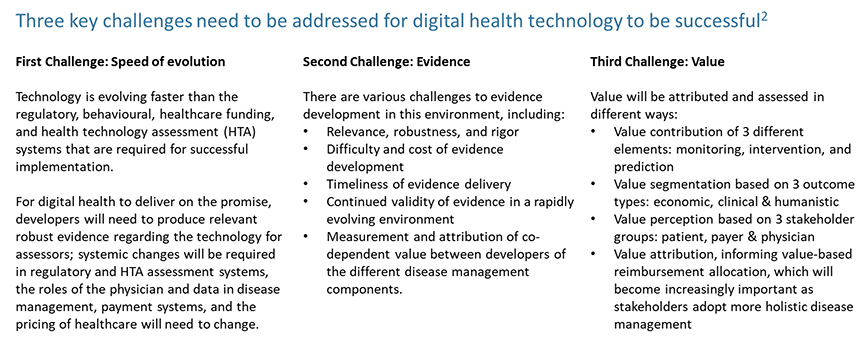

The largest challenge cluster related to “personalization” (digital and molecular diagnostics/biomarkers linked to therapeutics) and highlighted the key challenges that need to be addressed for digital health to be successful (Figure 1) and the barriers to effective use of molecular diagnostics and linked therapy use that will need to be removed for biomarker-driven healthcare to be successful (Figure 2).

Figure 1. Key Challenges

Figure 2. Key Barriers

Solutions

The research indicated that evidence pricing and access approaches will need to be re-engineered to address 4 factors: the evolution of science and technology, multicomponent disease management, multistakeholder value attribution, and multisource data integration.

Innovative approaches will increasingly be needed around evidence creation and the construction of pricing propositions. These will include multisource data modeling, conditional reimbursement/ coverage with evidence development, financial and outcomes-based risk sharing, and innovative funding models drawn from other industries (eg, financial services) such as monthly, quarterly, or annual “per patient subscription” and “reverse discounting/endowment life insurance” to reflect the risk equation changing as certainty of outcome increases.

"The research indicated that the challenges could rarely be overcome by companies working in isolation, or by limiting solutions to single data types or sources."

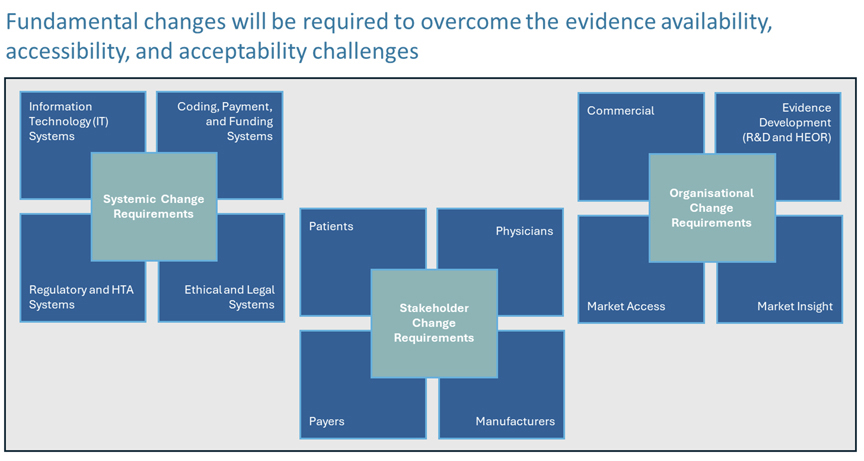

Solutions will require broad fundamental systemic, organizational, and stakeholder changes (Figure 3) to overcome the evidence availability, accessibility, assessment, and acceptability challenges. The implementation of these will take time and face considerable debate6 and opposition as witnessed in the United States (around Medicare price negotiation within the Inflation Reduction Act) and in Europe (around Joint Clinical Assessment and the revision of the EU Pharmaceutical strategy).

Strategic collaboration between manufacturers and data owners/providers will be required. Through such relationships, manufacturers will be able to more easily access comprehensive real-world data and real-time data, which they can utilize across their portfolios and in their interactions with payers. This does, however, raise potential additional ethical and legal challenges around data access, use, ownership, and patient rights. A recent example was Google and DeepMind facing claims for unauthorized and inappropriate National Health Service medical record use.7 There may be a need for data brokers as intermediaries between pharma and healthcare systems to audit data quality and between healthcare providers and pharma to improve public acceptability of data sharing.

Figure 3. Changes Required

Financial engineering will be needed to address the challenges of cell and gene therapies and other technologies with high price density or single one-off initial costs. These present specific challenges around cost and affordability, funding flows, uncertainty around long-term benefits, and value definition.4

"Innovative approaches will increasingly be needed around evidence creation and the construction of pricing propositions."

New payer-types will need to emerge. Examples might include creation of innovation “banks” utilizing money from the public purse, venture capital, and pharmaceutical and diagnostic companies that will invest in building the required infrastructure so that medical innovations can be introduced rapidly, while the financial arrangements are stabilized through consideration of attribution of value. Funding flows will need to change to relieve financial pressures. These are likely to include phased outcomes-based payments, expanded risk pools, annuities, mortgage/loans, re-insurance (where data would need to be shared with re-insurers in a similar way that pharma shares data with health technology assessment, to give them confidence that underwriting is possible), supplier credit, and direct payments. Any one or combination of these has the potential to incentivize payers, both traditional and new, to invest their limited financial resources.

References

- Top 10 HEOR Trends. ISPOR. https://www.ispor.org/heor-resources/about-heor/top-10-heor-trends. Accessed July 9, 2024.

- Teale CW. The monitor intervene predict framework. Value & Outcomes Spotlight. 2023;9(1). https://www.ispor.org/publications/journals/value-outcomes-spotlight/vos-archives/issue/view/addressing-assessment-and-access-issues-for-rare-diseases/the-monitor-intervene-predict-value-framework-a-structured-approach-to-demonstrating-how-digital-health-can-improve-health-outcomes-and-reduce-burden-of-illness. Accessed October 16, 2024.

- Teale C, Franceschetti A, Levent A, Duncan P. The power of holistic insight. Ispos. https://www.ipsos.com/sites/default/files/2022-11/Ipsos%20PoV_Power%20of%20Holistic%20Insight_Nov%202022_0.pdf. Published November 2022. Accessed October 16, 2024.

- Teale C. Pricing and access challenges in the absence of data: rare diseases, oncology and gene therapies [video]. https://www.ipsos.com/en-uk/pricing-and-access-challenges-absence-data-rare-diseases-oncology-and-gene-therapies. Published April 19, 2021. Accessed October 16, 2024.

- Morrison S, Ballantyne A. 30 major future challenges in evidence, pricing & access and how to overcome them. https://www.ipsos.com/en-uk/30-major-future-challenges-evidence-pricing-access-and-how-overcome-them. Published July 11, 2023. Accessed October 16, 2024.

- Alderson D, Brixner D, Teale C, Mettam S. International fallout: how the IRA in the US and JCA and revision of the EU pharmaceutical strategy in Europe will have global consequences. https://www.ispor.org/docs/default-source/intl2024/international-fallout-final-mayv2.pdf?sfvrsn=7d80e5be_0. Accessed October 16, 2024.

- Burgess M. HS DeepMind deal broke data protection law, regulator rules. Wired. https://www.wired.com/story/google-deepmind-nhs-royal-free-ico-ruling/. Published July 3, 2017. Accessed July 9, 2024.